Close

-

Legal Forms

By Category

- Advance Medical Directive Forms

- Affidavit and Declaration Forms

- Arbitration Forms

- Assignment Forms

- Auditor Forms

- Confidentiality Forms

- Court Forms

- Employment Contract Forms

- Energy and Environmental Forms

- Escrow Agreements

- Incorporation and Company Forms

- Independent Contractor Forms

- Intellectual Property Forms

- Landlord and Tenant Notices

- Law Office Management

- Letters of Intent

- Lien Forms

- Limited Liability Companies

- Marriage and Family Law

- Mergers, Amalgamations and Takeovers

- Partnerships and Joint Ventures

- Personal Guarantees

- Power of Attorney Forms

- Releases and Waivers

- Shareholder Forms

- Software Licensing and Development Forms

- Stock Options and Incentive Plans

- Trust Agreements

- Wills & Estate Planning Forms

-

Business Forms

By Category

- Advertising and Marketing Forms

- Animal Services Forms

- Bids, Tenders and Proposals

- Business and Marketing Plans

- Business Presentations

- Buying or Selling a Business

- Catering Forms

- Cleaning Contracts and Forms

- Construction Industry Forms

- Consulting Contract Forms

- Customer Service Forms

- Distributor and Dealership Agreements

- Equipment Sales and Leasing

- Film and TV Contracts

- Forms for Online Businesses

- Franchise Forms

- Graphic Arts Forms

- Health Services Forms

- Hotel Management Forms

- Information Technology Forms

- Manufacturing Forms

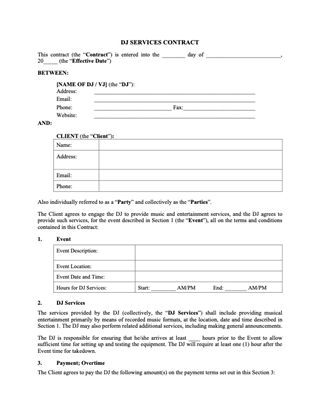

- Music Contracts

- Nanny and Childcare Forms

- Painting Contractor Forms

- Photographer Contracts

- Publishing Business Forms

- Purchasing Forms

- Restaurant Management Forms

- Roofing Contractor Forms

- Sales and Auction Forms

- Security Services

- Service Contracts

- Sports and Fitness Forms

- Starting Up a Small Business

- Storage Contracts and Parking Leases

- Vehicle Sales and Leasing Forms

- Website Development and Hosting

- Workplace Manuals and Policies

- Financial

- Property

- Discount Plans

- Subscribers

- My account

- Contact us

- Blog

Menu

-

Legal Forms

- back

- Advance Medical Directive Forms

- Affidavit and Declaration Forms

- Arbitration Forms

- Assignment Forms

- Auditor Forms

- Confidentiality Forms

-

Court Forms

- back

- CANADA

- UNITED STATES

- Employment Contract Forms

-

Energy and Environmental Forms

- back

-

CANADA

- back

- Alberta

- UNITED STATES

- Escrow Agreements

- Incorporation and Company Forms

- Independent Contractor Forms

- Intellectual Property Forms

-

Landlord and Tenant Notices

- back

- AUSTRALIA

- CANADA

- INDIA

- NEW ZEALAND

- UNITED KINGDOM

-

UNITED STATES

- back

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- Law Office Management

- Letters of Intent

-

Lien Forms

- back

- CANADA

-

UNITED STATES

- back

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- Limited Liability Companies

- Marriage and Family Law

- Mergers, Amalgamations and Takeovers

- Partnerships and Joint Ventures

- Personal Guarantees

-

Power of Attorney Forms

- back

- AUSTRALIA

- CANADA

- INDIA

- NEW ZEALAND

- UNITED KINGDOM

-

UNITED STATES

- back

- ARIZONA

- CALIFORNIA

- COLORADO

- DELAWARE

- FLORIDA

- GEORGIA

- HAWAII

- IDAHO

- ILLINOIS

- INDIANA

- IOWA

- KANSAS

- KENTUCKY

- LOUISIANA

- MAINE

- MARYLAND

- MASSACHUSETTS

- MICHIGAN

- MINNESOTA

- MISSISSIPPI

- MISSOURI

- MONTANA

- NEBRASKA

- NEVADA

- NEW HAMPSHIRE

- NEW JERSEY

- NEW MEXICO

- NEW YORK

- NORTH CAROLINA

- NORTH DAKOTA

- OHIO

- OKLAHOMA

- OREGON

- PENNSYLVANIA

- RHODE ISLAND

- SOUTH CAROLINA

- SOUTH DAKOTA

- TENNESSEE

- TEXAS

- UTAH

- VERMONT

- VIRGINIA

- WASHINGTON

- WEST VIRGINIA

- WISCONSIN

- Wyoming

-

Releases and Waivers

- back

- CANADA

- UNITED STATES

- Shareholder Forms

- Software Licensing and Development Forms

-

Stock Options and Incentive Plans

- back

- CANADA

- UNITED STATES

-

Trust Agreements

- back

- CANADA

- UNITED STATES

- Wills & Estate Planning Forms

-

Business Forms

- back

- Advertising and Marketing Forms

- Animal Services Forms

- Bids, Tenders and Proposals

- Business and Marketing Plans

- Business Presentations

- Buying or Selling a Business

- Catering Forms

- Cleaning Contracts and Forms

- Construction Industry Forms

- Consulting Contract Forms

- Customer Service Forms

-

Distributor and Dealership Agreements

- back

- CANADA

- UNITED STATES

- Equipment Sales and Leasing

-

Film and TV Contracts

- back

- Cast and Crew Contracts

- Film Clearance and Release Forms

- Film Distribution and Licensing Forms

- Film Financing and Budget Forms

- Film Production Logs and Forms

- Film Tax Credit Forms

- Rental Contracts for Film and TV

- Script and Screenwriter Forms

- Soundtracks and Scores

- Theater Production Forms

- TV Production Contracts

- Video Production Forms

- Forms for Online Businesses

- Franchise Forms

- Graphic Arts Forms

- Health Services Forms

- Hotel Management Forms

- Information Technology Forms

- Manufacturing Forms

- Music Contracts

- Nanny and Childcare Forms

- Painting Contractor Forms

- Photographer Contracts

- Publishing Business Forms

- Purchasing Forms

- Restaurant Management Forms

- Roofing Contractor Forms

- Sales and Auction Forms

- Security Services

- Service Contracts

- Sports and Fitness Forms

- Starting Up a Small Business

- Storage Contracts and Parking Leases

-

Vehicle Sales and Leasing Forms

- back

- AUSTRALIA

- CANADA

- UNITED STATES

-

Website Development and Hosting

- back

- CANADA

- CHINA

- INDIA

- UNITED STATES

- Workplace Manuals and Policies

-

Financial

- back

- Accounts Receivable & Credit Forms

- Asset Protection and Tax Planning

- Bankruptcy Forms

- Bill of Sale Forms

- Financial Service Contracts

- Insurance Forms

-

Investor Forms

- back

- CANADA

- UNITED STATES

- Loan Transaction Forms

-

Mortgage Forms

- back

- CANADA

-

UNITED STATES

- back

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

-

Promissory Note Forms

- back

- CANADA

- UNITED STATES

- Retirement Planning Information

- Succession Planning

-

Property

- back

-

Commercial Lease Forms

- back

- AUSTRALIA

- CANADA

- CHINA

- INDIA

- NEW ZEALAND

- UNITED KINGDOM

-

UNITED STATES

- back

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- Condominium and Strata Forms

-

Facility Rental Forms

- back

- CANADA

- UNITED STATES

-

Farm Land Leases

- back

- CANADA

- UNITED STATES

- Hunting and Fishing Leases

-

Mobile Home Forms

- back

- AUSTRALIA

- CANADA

- UNITED STATES

- Property Appraisal Forms

-

Real Estate Forms

- back

- AUSTRALIA

- CANADA

- INDIA

- MEXICO

- NEW ZEALAND

- UNITED KINGDOM

-

UNITED STATES

- back

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

-

Rental Property Management Forms

- back

- AUSTRALIA

- CANADA

- NEW ZEALAND

- UNITED KINGDOM

-

UNITED STATES

- back

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

-

Residential Lease and Tenancy Forms

- back

- AUSTRALIA

- CANADA

- INDIA

- NEW ZEALAND

- UNITED KINGDOM

-

UNITED STATES

- back

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- Vacation Property Rental Forms

- Discount Plans

- Subscribers

- My account

- Contact us

- Blog

(0)

items

You have no items in your shopping cart.

All Categories

Menu

Shopping cart

Filters

Personal menu

Preferences

Search

RSS

New products

Latest From Blog

5/3/2024 8:23:26 AM

0

Evaluating a Business to Purchase - 16 Questions to Ask When Buying a Business

Are you thinking of buying an existing business? There are number of issues you should consider.Get the answers to the following 16 questions during your due diligence review. The answers will help yo...

4/4/2024 8:54:39 AM

0

How to Protect Your Business From Creditors

One of the biggest risks for any small business owner is the possibility of facing a lawsuit or a debt collection from creditors. If you have invested a lot of your personal assets into your business,...

3/20/2024 10:36:55 AM

0

Using AI-Generated Content: What Are Your Legal Obligations?

The ever-increasing reliance of content producers on artificial intelligence apps to generate content for online use begs the question of what legal obligations and liability risks arise from the use ...

What can we help you find today?

Information

Customer service

My account

Contact Us

- Calgary, Alberta, Canada

- info@megadox.com